EU and U.K. sanctions against Russian energy have resulted in volatility in the European power markets. High energy prices typically signal an economic downturn as consumers respond to the higher prices by reducing their spending on goods and services. Inflation has hit 9.7% y/y in August, worsening the slowdown in economic growth.

While relief measures to reduce the economic damage caused by a continentwide natural gas supply crunch have been unveiled the U.K and Germany, Goldman Sachs analyst Alberto Gandolfi wrote that the scope of the price caps contemplated “would not fully solve the affordability issue”.

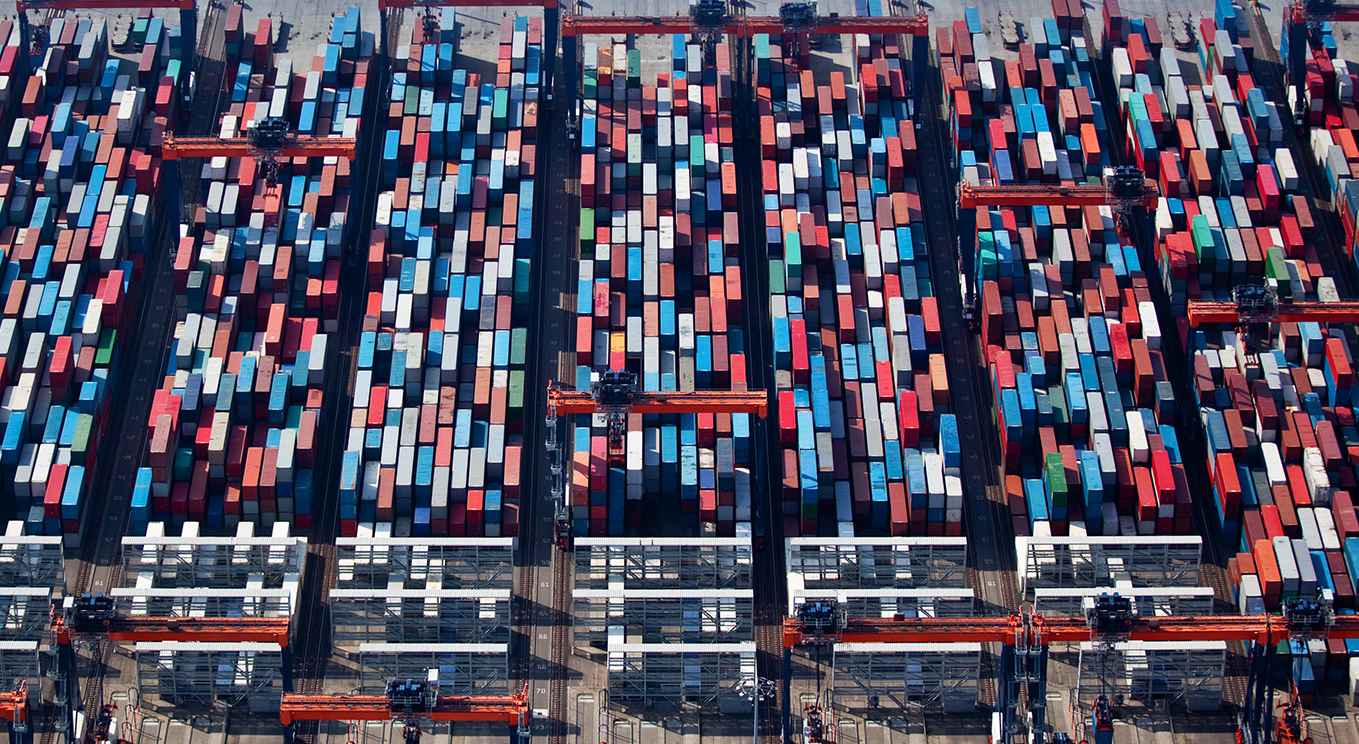

Ocean container rates from Asia to Europe have dropped substantially since the beginning of the year on waning demand. Carriers could potentially respond to softening demand by trimming capacity, switching out vessels on the main services with smaller ships and deploying those assets elsewhere. However, they will be faced with a conundrum as Trans-Pacific ocean container spot rates are similarly depressed on softening demand.

Upstream ocean container bookings data from FreightWaves Container Atlas reveals that European exports are set to slow markedly. The Ocean Booking Volume Index from Rotterdam to all global ports is down by 25.4% since July 5 although it is still at an elevated level compared to pre-pandemic freight flows (see Figure 1).

Transportation Intelligence economic analyst Nathaniel Donaldson noted road freight rates across the European continent have also reached new highs. “Initial fuel price rises following the invasion of Ukraine have held and produced a much more costly environment for European road carriers whilst industrial action and a worsening driver shortage keep capacity tight. A range of indicators are pointing towards a drastic slowdown in consumption and production, which will ease further increases while high costs keep rates elevated.”

The EU energy crisis has already taken a bite out of Europe’s consumption and production, weakening demand for transportation capacity in, through and out of the region. Recently announced fiscal relief measures will likely not be large enough to avert an acute economic slowdown, with knock-on effects for global transportation markets like ocean container freight.

Source: American Shipper

According to the International Air Transport Association (IATA), air cargo demand fell again in July but there are indications the demand gap is closing in at near pre-pandemic levels.

ir cargo traffic measured in cargo tonne-kilometers (CTKs), fell -9.7% compared to July 2021, the fifth consecutive month of decline. IATA noted that several factors should be considered when looking at the figures. The airline associated said, “New export orders, a leading indicator of cargo demand, decreased in all markets, except China which began a sharp upward trend in June,” and added, “The war in Ukraine continues to impair cargo capacity used to serve Europe as several airlines based in Russia and Ukraine were key cargo players.”

Air cargo traffic measured in cargo tonne-kilometers (CTKs), fell -9.7% compared to July 2021, the fifth consecutive month of decline. IATA noted that several factors should be considered when looking at the figures. The airline associated said, “New export orders, a leading indicator of cargo demand, decreased in all markets, except China which began a sharp upward trend in June,” and added, “The war in Ukraine continues to impair cargo capacity used to serve Europe as several airlines based in Russia and Ukraine were key cargo players.”

IATA noted there were some positives with cargo traffic closing the gap to 2019 levels being only -3.5% down. The airline association noted that global goods trade continued to recover in the second quarter. Additionally, the easing of pandemic related restrictions in China will further improve recovery in the coming months. “While maritime will be the main beneficiary, air cargo is set to receive a boost,” IATA said.

Willie Walsh, IATA’s director general said, “Air cargo is tracking at near 2019 levels although it has taken a step back compared to the extra-ordinary performance of 2020-2021. Volatility resulting from supply chain constraints and evolving economic conditions has seen cargo markets essentially move sideways since April. July data shows us that air cargo continues to hold its own, but as is the case for almost all industries, we’ll need to carefully watch both economic and political developments over the coming months.”

Source: Air Cargo News

Containers were held up within the supply chain when transit times lengthened, and not enough empty containers could be moved back out to Asia in time. This was what caused the initial increases in freight rates in the second half of 2020, Sea-Intelligence said in its latest update as the company re-assessed its February 2022 projection on the potential impact on empty container flows upon the “eventual normalization of the supply chain”.

“With a massive shortage of empty containers, carriers had to order new containers to be manufactured in Asia,and these were then fed into the extended supply chains. As transportation time is now getting shorter, these additional containers will be released back out of the supply chain, and they will start to pile up, primarily in Europe and the U.S.,” said Alan Murphy, CEO, Sea-Intelligence.

The blue line shows the current projection of excess empty containers that will be released into North America from the Trans-Pacific trade, and the orange line shows projection from February 2022 (see Figure 1).

“If transportation time is back to “normal” by early next year, we will see the release of 4.3 million TEU of excess containers into North America, which cannot be expatriated, within the planned network operations. This will potentially overwhelm empty container depots in the U.S., an issue which is already beginning to materialize,” Murphy added.

Source: Sea-Intelligence

VesselsValue’s recent data revealed that following the late-August walkout at the Port of Felixstowe due to pay disputes, some container operators were unable to make alternative voyage plans, resulting in extended wait times at Felixstowe.

Average waiting times have tripled from 10 hours at the beginning of August to the 30-hour mark (see Figure 1). Back in March, container boxes had towait up to 40 hours to enter Felixstowe so the current decrease in waiting time suggests that the fallout from the most recent strike has reached it apex, said Peter Williams, VesselValue’s Trade Flow Analyst.

The waiting times have reached similar congestion levels of August 2021 which resulted in skipped port calls by container carriers such as Maersk. According to the data, except for Rotterdam, the amount of TEU that has headed to Felixstowe’s neighboring ports during the strike period has increased compared to the same duration last year (see Figure 2). The shift of cargo shows container operators have had sufficient flexibility in their schedule to accommodate the eight-day strike said VesselsValue.

Meanwhile, over 560 dockworkers at the Port of Liverpool have planned a two-week strike from September 19 to October. 3 over an “inadequate” pay raise offer, the latest wave of labor action to hit UK ports.

Source: Port Technology

The Association of American Railroads (AAR) trade group estimates that a nationwide shutdown of rail operations could cost US$2 billion in lost economic output each day. According to a report released on September 8, the AAR said a short-term switch to trucks or barges “would be costly and disruptive,” with an additional 467,000 long-haul trucks needed per day to handle the freight that would have otherwise gone on rail.

The unions and the railroads have been at negotiations since January 2020, but a new labor deal has yet to be reached. Under the federal law that governs railroad negotiations, both sides have until midnight on September 16 to come to a consensus. Following that, the “cooling-off” period ends, and union members could decide to go on strike. Five unions have announced tentative agreements while some of the larger unions are still in discussions.

Shippers have started to press Congress to intervene should a strike be imminent. The National Retail Federation (NRF) sent a letter addressed to the majority and minority leaders of the U.S. House and Senate expressing its concern about a potential disruption in rail service. “Our nation’s retailers continue to meet strong consumer demand despite continued supply chain challenges. The goods and services tied to retailers are a key part of needed economic growth — despite various economic headwinds — and they require continued improvements and fluidity in the supply chain. … If the remaining unions do not agree to a deal by Sept. 16, there is real concern for a strike that could shut down the system,” said the letter signed by David French, NRF’s senior vice president of government relations.

The AAR said a strike would idle some 7,000 freight trains a day run by CSX, Union Pacific, BNSF, Norfolk Southern, Kansas City Southern and other railroads.

Source: American Shipper